Safeguarding Your Ride – The Comprehensive Guide to Auto Insurance

Auto insurance is a crucial aspect of responsible vehicle ownership, providing financial protection in the event of accidents, theft, or other unforeseen circumstances. It not only ensures compliance with legal requirements but also offers peace of mind to drivers and their loved ones. As the automotive industry continues to evolve, understanding the intricacies of auto insurance has become increasingly important.

Understanding Auto Insurance

Auto insurance is a contract between an individual and an insurance provider, where the insurer agrees to cover specific financial losses or liabilities in exchange for a premium paid by the policyholder. This coverage can include protection against damages to the vehicle, liability for injuries or property damage caused to others, and various other scenarios.

The Importance of Auto Insurance

Auto insurance serves as a safety net, safeguarding drivers from the potentially devastating consequences of accidents or unexpected incidents. It helps to mitigate the financial burden of vehicle repairs, medical expenses, and legal liabilities, ensuring that individuals can get back on the road with minimal disruption to their lives.

The Key Components of Auto Insurance

Auto insurance policies typically consist of several key components, including liability coverage, collision coverage, comprehensive coverage, and additional optional features. Understanding these elements is crucial for selecting the right policy that meets your specific needs and budget.

Factors Affecting Auto Insurance Rates

The cost of auto insurance can vary significantly based on a variety of factors, such as the driver’s age, driving history, the make and model of the vehicle, geographic location, and the level of coverage desired. Knowing these factors can help drivers make informed decisions and potentially lower their insurance premiums.

Navigating the Auto Insurance Landscape

Choosing the right auto insurance policy can be a daunting task, with a multitude of providers, coverage options, and pricing structures to consider. However, with the right information and strategies, drivers can navigate this landscape effectively and find the coverage that best suits their needs.

Researching and Comparing Insurance Providers

Before selecting an insurance provider, it’s essential to research and compare different companies, their coverage options, customer satisfaction ratings, and financial stability. This can be done through online comparisons, reviews, and recommendations from trusted sources.

Understanding Coverage Options and Deductibles

Exploring the various coverage options, such as liability, collision, and comprehensive, as well as the corresponding deductibles, can help drivers make informed decisions and find the right balance between coverage and cost.

Maximizing Discounts and Savings

Many insurance providers offer a range of discounts, from good driving records and safety features to bundling policies and maintaining continuous coverage. Identifying and taking advantage of these savings can significantly reduce the overall cost of auto insurance.

Handling Auto Insurance Claims

When the unexpected happens, navigating the claims process can be a crucial step in ensuring a smooth recovery and the timely restoration of your vehicle. Understanding the claims process and best practices can help drivers minimize stress and maximize their insurance benefits.

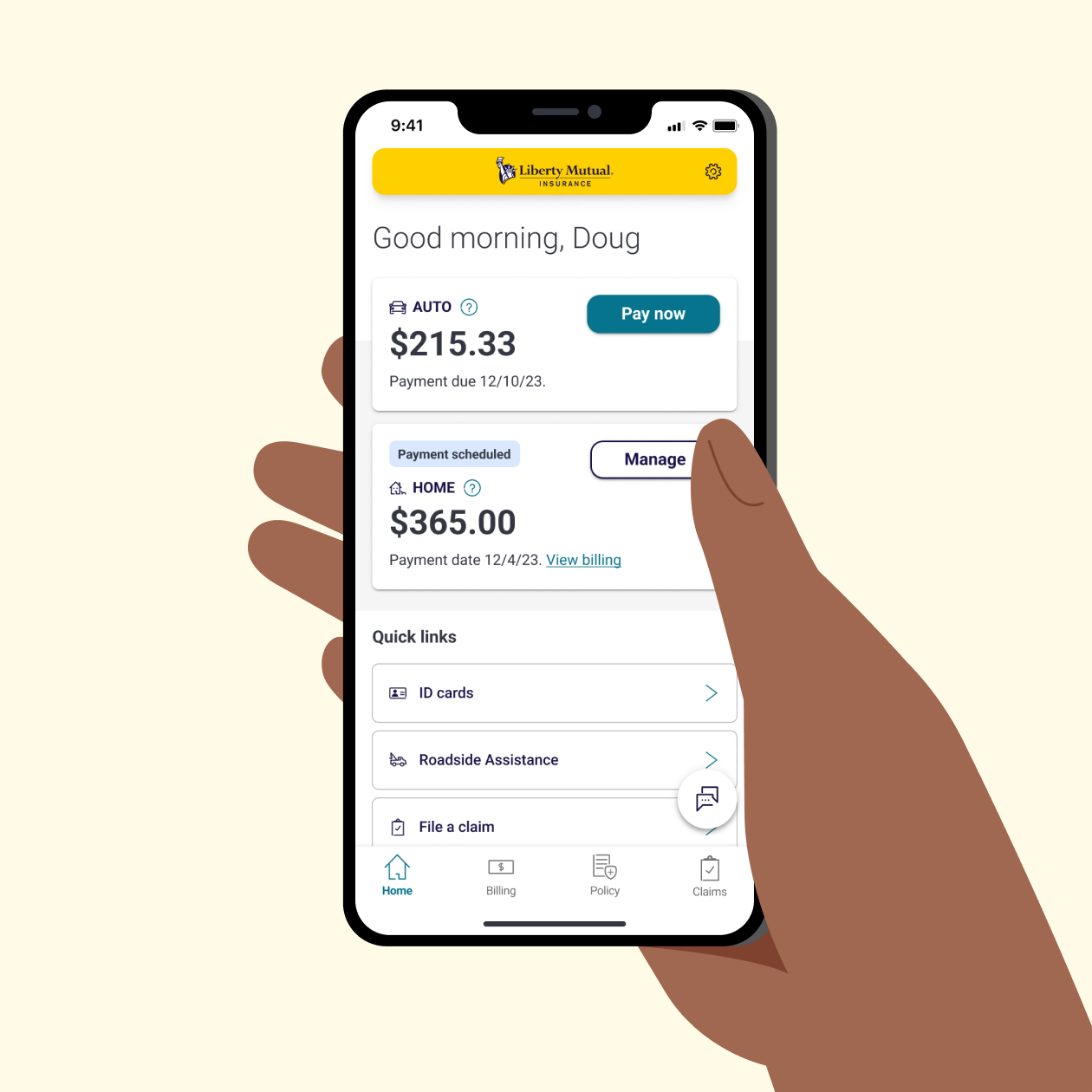

The Claims Reporting Process

Knowing the steps to report a claim, including gathering necessary information, contacting the insurance provider, and providing detailed documentation, can streamline the claims process and expedite the resolution.

Working with Insurance Adjusters

Effectively communicating with insurance adjusters, providing accurate information, and understanding their role in the claims process can help drivers advocate for their interests and ensure a fair settlement.

Resolving Disputes and Appeals

In some cases, disagreements may arise regarding the coverage or settlement amount. Knowing the steps to file appeals and engage in dispute resolution can help drivers protect their rights and achieve a satisfactory outcome.

Proactive Strategies for Reducing Auto Insurance Costs

While auto insurance is a necessary expense, there are various proactive strategies that drivers can employ to manage and potentially lower their insurance costs over time.

Maintaining a Clean Driving Record

Avoiding traffic violations, accidents, and other incidents can have a significant impact on insurance premiums, as insurers often reward safe driving with lower rates.

Selecting the Appropriate Vehicle

The make, model, and safety features of a vehicle can directly influence the cost of auto insurance. Researching and choosing a vehicle that aligns with your insurance needs can lead to substantial savings.

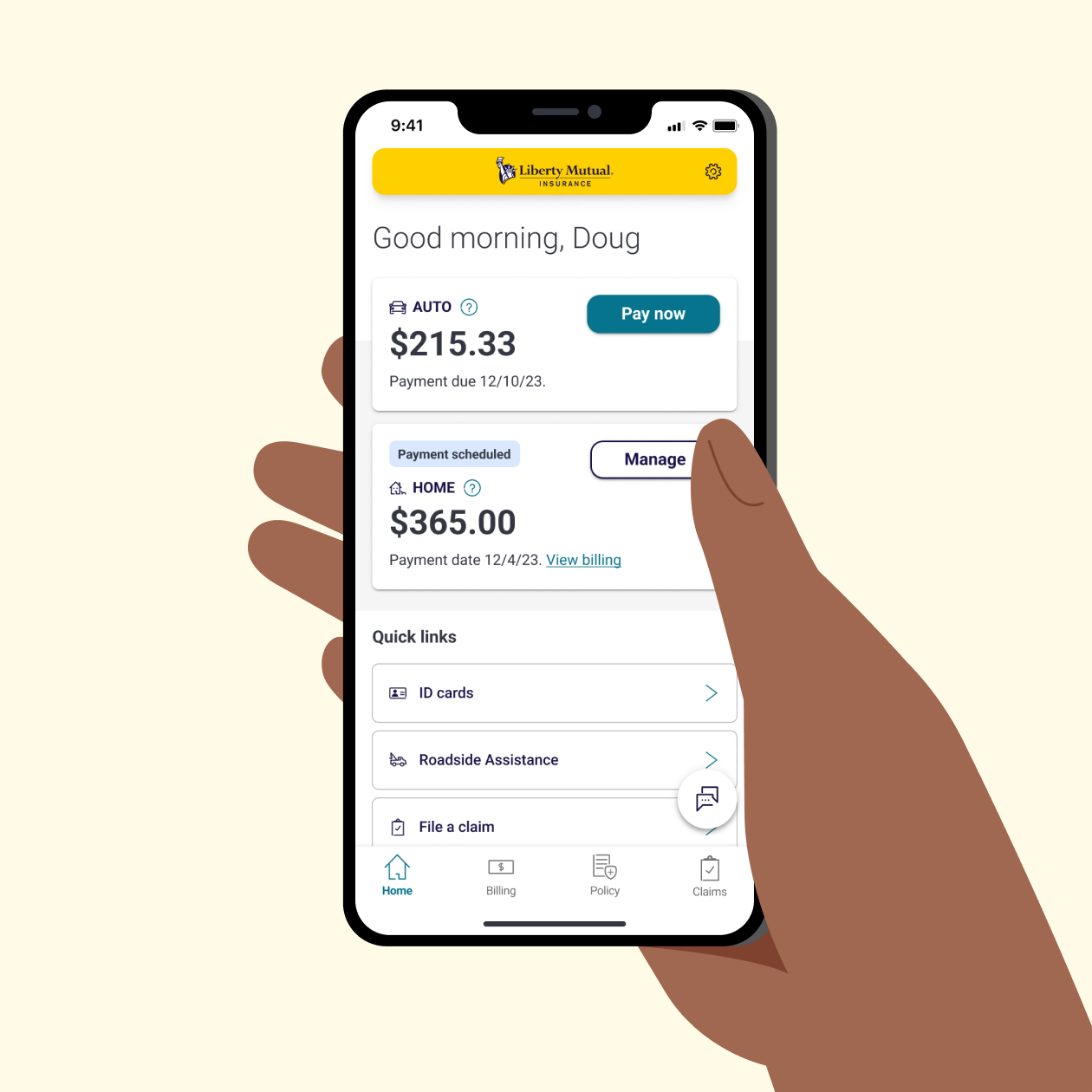

Leveraging Bundling and Loyalty Discounts

Consolidating your insurance policies, such as auto and homeowner’s insurance, with a single provider can often result in significant discounts. Additionally, maintaining a long-standing relationship with an insurer may earn you loyalty-based savings.

FAQs

What is the minimum auto insurance coverage required by law?

The minimum auto insurance coverage required by law varies by state, but typically includes liability insurance to cover damages and injuries caused to others in an accident. Most states require a minimum of 25/50/25 coverage, which means $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $25,000 for property damage per accident.

How can I compare auto insurance quotes?

Comparing auto insurance quotes can be done through various online platforms that allow you to input your personal and vehicle information, and then receive quotes from multiple providers. This allows you to compare coverage options, deductibles, and premiums side-by-side to find the best fit for your needs and budget.

What factors can affect my auto insurance rates?

There are several factors that can affect your auto insurance rates, including your driving history, age, gender, credit score, the type of vehicle you drive, your location, and the level of coverage you choose. Insurers use these factors to assess the level of risk you pose and determine the appropriate premium.

How can I lower my auto insurance costs?

There are several strategies to help lower your auto insurance costs, such as maintaining a good driving record, choosing a vehicle with safety features, taking advantage of available discounts (e.g., good driver, multi-policy, and low mileage discounts), and increasing your deductible. Regularly reviewing and comparing quotes from different providers can also help you find the most competitive rates.

What should I do if I’m in an accident?

If you’re involved in an accident, the first step is to ensure the safety of everyone involved and call the police to report the incident. Gather as much information as possible, including the other driver’s contact and insurance details, as well as photographs of the accident scene and any damage. Promptly report the claim to your insurance provider and cooperate with their investigation to ensure a smooth claims process.

Conclusion

Auto insurance is a crucial aspect of responsible vehicle ownership, providing financial protection and peace of mind in the event of unexpected incidents. By understanding the key components of auto insurance, navigating the insurance landscape, and implementing proactive strategies, drivers can ensure that they are adequately protected while also managing their insurance costs effectively. As the automotive industry continues to evolve, staying informed and making informed decisions about auto insurance will remain a vital part of the driving experience.