Safeguarding Your Business The Comprehensive Guide to Business Insurance

Business insurance is a crucial aspect of any successful enterprise, providing the necessary protection and peace of mind for business owners and entrepreneurs. From protecting against unexpected risks to ensuring financial stability, a well-designed insurance plan can make all the difference in the long-term viability of a company.

The Essentials of Business Insurance

Understanding the Basics of Business Insurance

Business insurance is a broad term that encompasses a variety of policies designed to protect a company from various risks. These policies can cover a wide range of contingencies, including property damage, liability claims, employee-related incidents, and more. Understanding the different types of coverage available and how they can benefit your business is the first step in creating a comprehensive insurance strategy.

Evaluating Your Business Needs

Every business is unique, with its own set of risks and exposures. Conducting a thorough risk assessment is essential in determining the specific insurance needs of your company. This process involves identifying potential threats, evaluating the likelihood and severity of these risks, and then selecting the appropriate insurance coverage to mitigate them.

Navigating the Business Insurance Landscape

The business insurance market can be complex, with a wide range of providers, policy options, and coverage levels. Navigating this landscape can be a daunting task, but it’s crucial to finding the right insurance solutions for your business. Partnering with an experienced insurance broker or advisor can be invaluable in helping you navigate the options and ensure your coverage is comprehensive and tailored to your needs.

Protecting Your Assets: Property and Liability Insurance

Safeguarding Your Physical Assets

One of the primary concerns for any business is protecting its physical assets, such as buildings, equipment, and inventory. Property insurance is designed to cover the cost of repairing or replacing these assets in the event of a covered loss, such as a fire, natural disaster, or theft. Understanding the different types of property insurance, including building, contents, and business interruption coverage, can help you ensure your business is adequately protected.

Mitigating Liability Risks

Businesses face a wide range of liability risks, from customer injuries to professional errors and omissions. Liability insurance is designed to protect your business from the financial consequences of these types of claims, covering legal fees, settlement costs, and any awarded damages. Evaluating your potential liability exposures and selecting the appropriate coverage, such as general liability, professional liability, or product liability insurance, is crucial in safeguarding your business.

Addressing Unique Industry Risks

Depending on the nature of your business, you may face specific risks that require specialized insurance coverage. For example, a construction company may need to consider surety bonds, while a healthcare provider may need medical malpractice insurance. Understanding the unique insurance needs of your industry and working with an experienced insurance provider can help ensure your business is fully protected.

Protecting Your People: Employee-Focused Insurance

Providing Workers’ Compensation Coverage

Workers’ compensation insurance is a legal requirement in most states, providing benefits to employees who are injured or become ill on the job. This coverage can help cover medical expenses, lost wages, and other related costs, while also protecting your business from liability. Ensuring you have the appropriate workers’ compensation coverage in place is crucial in meeting your legal obligations and supporting your employees.

Offering Employee Benefits

In addition to workers’ compensation, many businesses choose to offer a range of employee benefits, such as Health insurance, Life insurance, and disability coverage. These benefits can play a crucial role in attracting and retaining top talent, while also demonstrating your commitment to the well-being of your workforce. Understanding the various employee benefit options and how they can be tailored to your business and employee needs is essential in creating a comprehensive benefits package.

Addressing Specialty Employee Risks

Depending on the nature of your business, you may have employees who face unique risks or require specialized coverage. For example, a transportation company may need to consider commercial Auto insurance for its drivers, or a technology firm may need to consider cyber liability insurance to protect against data breaches. Identifying these specialized risks and implementing the appropriate insurance solutions can help ensure your employees are fully protected.

Managing Risks Beyond Your Control

Protecting Against Cyber Threats

In today’s digital landscape, businesses of all sizes are vulnerable to cyber threats, such as data breaches, ransomware attacks, and other forms of cybercrime. Cyber liability insurance can help mitigate the financial and reputational impact of these events, covering the costs of incident response, data restoration, and liability claims. Evaluating your cyber risk exposure and implementing a comprehensive cyber insurance strategy is crucial in safeguarding your business.

Preparing for Natural Disasters

Natural disasters, such as hurricanes, earthquakes, or floods, can have a devastating impact on businesses, causing physical damage, disrupting operations, and leading to significant financial losses. Business interruption insurance and other specialized disaster coverage can help protect your company in the event of a natural calamity, ensuring you have the resources to recover and resume operations.

Protecting Against Unexpected Events

In addition to cyber threats and natural disasters, businesses may face a range of other unexpected events that can have significant consequences, such as political unrest, terrorism, or supply chain disruptions. Specialized insurance solutions, such as political risk insurance or trade credit insurance, can help mitigate the financial impact of these types of events, providing your business with the protection it needs to navigate unpredictable circumstances.

FAQs

What are the most common types of business insurance coverage?

The most common types of business insurance coverage include:

- General liability insurance: Protects against claims of bodily injury, property damage, and personal/advertising injury.

- Property insurance: Covers the cost of repairing or replacing your business’s physical assets, such as buildings, equipment, and inventory.

- Workers’ compensation insurance: Provides benefits to employees who are injured or become ill on the job.

- Commercial auto insurance: Covers vehicles used for business purposes, including liability, collision, and comprehensive coverage.

- Professional liability insurance: Protects against claims of negligence, errors, or omissions in the provision of professional services.

How much does business insurance typically cost?

The cost of business insurance can vary significantly depending on factors such as the size of your business, the industry you operate in, the specific coverages you need, and your claims history. On average, small businesses can expect to pay between $500 and $3,000 per year for a basic business insurance policy. However, larger or higher-risk businesses may have significantly higher premiums.

What factors should I consider when choosing a business insurance provider?

When selecting a business insurance provider, it’s important to consider factors such as the provider’s financial stability, customer service reputation, claims handling process, and the breadth and customization of their insurance offerings. It’s also important to work with a provider that has experience in your specific industry and can provide guidance on the coverages that are most relevant to your business.

How can I save money on business insurance premiums?

There are several ways to potentially save on business insurance premiums, including:

- Increasing your deductibles: Higher deductibles typically result in lower premiums.

- Bundling policies: Purchasing multiple insurance policies from the same provider can often result in discounts.

- Implementing risk-reduction measures: Investing in safety equipment, training programs, or other risk-mitigation strategies can demonstrate to insurers that your business is a lower risk.

- Reviewing your coverage regularly: Regularly evaluating your insurance needs and adjusting your coverage accordingly can help ensure you’re not paying for unnecessary protection.

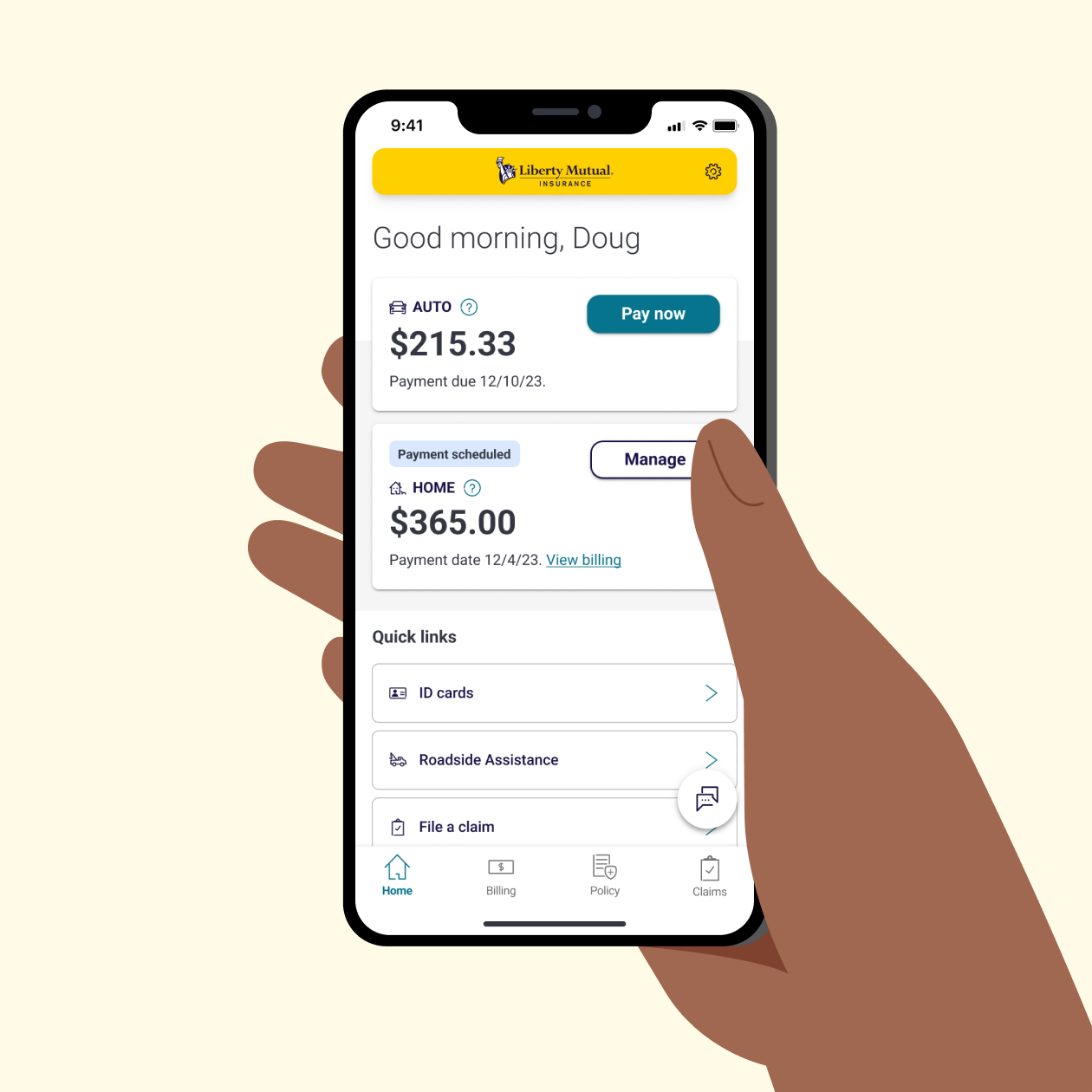

What should I do if I need to file a business insurance claim?

If you need to file a business insurance claim, it’s important to follow the specific procedures outlined by your insurance provider. This typically involves:

- Reporting the incident or loss to your insurance provider as soon as possible.

- Providing detailed documentation, such as receipts, invoices, and photographs, to support your claim.

- Cooperating with any investigations or requests for additional information from the insurance provider.

- Keeping detailed records of all communication and actions taken during the claims process.

Conclusion

Business insurance is a critical component of any successful enterprise, providing the necessary protection and peace of mind for business owners and entrepreneurs. By understanding the essentials of business insurance, evaluating your specific needs, and navigating the complex insurance landscape, you can ensure your company is fully protected against a wide range of risks.

From safeguarding your physical assets and mitigating liability exposures to protecting your employees and managing risks beyond your control, a comprehensive business insurance strategy can be the key to long-term success and sustainability. By partnering with experienced insurance professionals and staying up-to-date on the latest industry trends and best practices, you can develop a customized insurance plan that meets the unique needs of your business and helps you navigate the challenges and uncertainties of the modern business environment.