Protecting Your Home The Comprehensive Guide to Home Insurance

Home insurance is a crucial financial safeguard that provides coverage for your most valuable asset – your home. Whether you’re a homeowner or a renter, understanding the intricacies of home insurance can help you make informed decisions and ensure that your property and belongings are protected in the event of unexpected challenges.

Understanding Home Insurance

Home insurance is a contract between you and an insurance provider that offers protection against various risks. It typically covers the structure of your home, your personal possessions, and liability for injuries or property damage that occur on your property. The coverage and premiums can vary depending on factors such as the location, age, and condition of your home, as well as your personal needs and preferences.

Evaluating Your Home Insurance Needs

When it comes to home insurance, one size does not fit all. Your specific needs will depend on the value of your home, the value of your personal belongings, and the potential risks you face. It’s essential to carefully consider the following factors when selecting a home insurance policy:

- Home Value: Ensure that your policy provides sufficient coverage to rebuild your home in the event of a total loss.

- Personal Belongings: Determine the value of your personal possessions and choose a policy that offers adequate coverage.

- Liability Coverage: Protect yourself from claims of bodily injury or property damage that occur on your property.

- Deductibles: Understand the impact of deductibles on your premiums and choose a level that fits your budget.

- Discounts: Look for opportunities to save on your premiums, such as bundling your home and Auto insurance or installing security systems.

Types of Home Insurance Coverage

Home insurance policies typically offer several types of coverage, each designed to address specific risks:

- Dwelling Coverage: Protects the structure of your home, including the walls, roof, and foundation.

- Personal Property Coverage: Covers the replacement or repair of your personal belongings, such as furniture, electronics, and clothing.

- Liability Coverage: Provides protection if someone is injured on your property or if you are found legally liable for damages.

- Additional Living Expenses: Covers the costs of temporary housing and other expenses if your home becomes uninhabitable due to a covered event.

Understanding the different types of coverage and how they apply to your specific situation will help you select the most comprehensive and tailored home insurance policy.

Navigating the Home Insurance Landscape

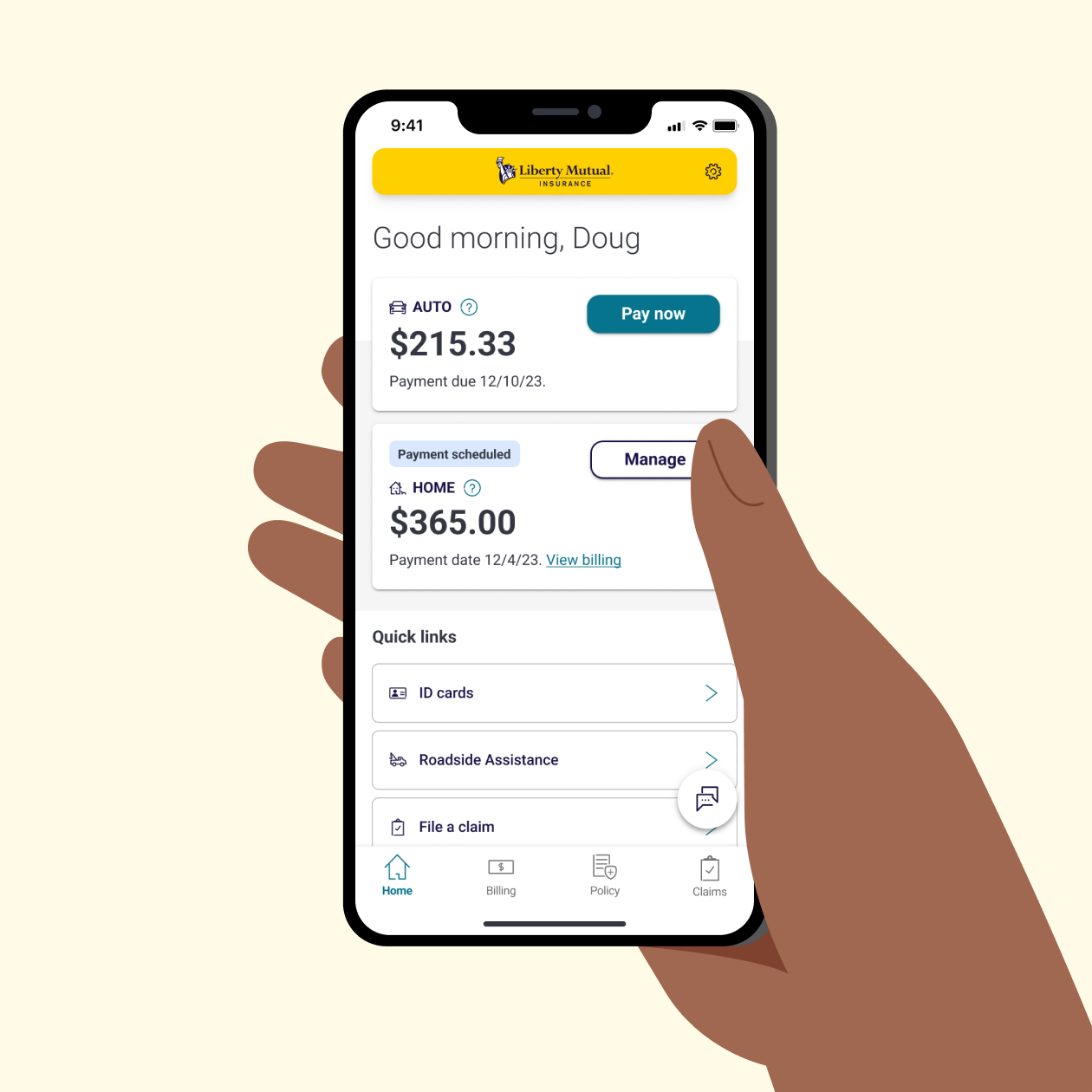

The home insurance market can be complex, with many insurance providers offering a variety of policies and coverage options. Navigating this landscape can be daunting, but with the right strategies and knowledge, you can find the perfect policy to meet your needs.

Researching Insurance Providers

When it comes to selecting a home insurance provider, it’s essential to do your due diligence. Look for insurance companies with a strong financial rating, a proven track record of customer satisfaction, and a wide range of coverage options. Compare quotes from multiple providers to ensure you’re getting the best value for your money.

Evaluating Policy Coverage and Exclusions

Carefully review the details of each home insurance policy, paying close attention to the coverage inclusions and exclusions. Understand what events and damages are covered, as well as any limitations or restrictions on the coverage. This will help you make an informed decision and avoid any unpleasant surprises if you need to file a claim.

Considering Supplemental Coverage

In addition to the standard home insurance policy, you may want to consider supplemental coverage options to address specific risks. This could include flood insurance, earthquake coverage, or additional personal property protection. Evaluate your needs and the potential risks in your area to determine if any supplemental coverage would be beneficial.

Maximizing Your Home Insurance Coverage

Once you’ve selected a home insurance policy, it’s important to understand how to optimize your coverage and ensure that your home and belongings are adequately protected.

Maintaining Accurate Home Valuations

Regularly updating the valuation of your home and personal possessions is crucial to ensuring that your insurance coverage keeps pace with changes in the market. This can help you avoid being underinsured in the event of a claim.

Documenting Your Belongings

Creating a comprehensive inventory of your personal belongings can make the claims process much smoother if you ever need to file a claim. This can be done through photographs, videos, or a detailed written list.

Reviewing and Updating Your Policy

Life changes, and so do your insurance needs. Regularly reviewing your home insurance policy and updating it as needed can help ensure that you maintain the appropriate level of coverage. This may include adjusting coverage limits, adding or removing riders, or exploring new discounts.

Navigating the Claims Process

If disaster strikes and you need to file a home insurance claim, it’s essential to understand the process and be prepared to navigate it effectively.

Initiating the Claims Process

When an event occurs that may result in a claim, it’s important to contact your insurance provider as soon as possible. Be prepared to provide detailed information about the incident and any damage or losses.

Documenting the Damage

Thoroughly documenting the damage to your home and personal belongings is crucial for a successful claims process. Take photographs, make lists, and gather any relevant receipts or documentation.

Cooperating with the Insurance Adjuster

When the insurance adjuster arrives to assess the damage, be prepared to provide them with the information and documentation they need. Cooperate fully and be available to answer any questions they may have.

Understanding the Claims Settlement

Once the claims process is complete, the insurance provider will provide you with a settlement offer. Review this offer carefully and understand your rights and options if you feel the settlement is not adequate.

FAQs

What factors affect the cost of home insurance?

The cost of home insurance can be influenced by several factors, including the location, age, and condition of your home, the value of your personal belongings, your claims history, and the coverage limits you choose.

Do I need flood insurance if I’m not in a high-risk flood zone?

Even if your home is not located in a designated high-risk flood zone, it’s still a good idea to consider purchasing flood insurance. Floods can occur anywhere, and standard home insurance policies typically do not cover flood-related damage.

How can I save money on my home insurance premiums?

There are several ways to save on home insurance premiums, such as bundling your home and auto insurance, increasing your deductible, taking advantage of discounts for home security systems or storm-resistant features, and maintaining a good claims history.

What is the difference between replacement cost and actual cash value coverage?

Replacement cost coverage pays the full cost of repairing or replacing your damaged or stolen items, while actual cash value coverage takes into account the depreciation of your items and pays a lower amount.

How often should I review and update my home insurance policy?

It’s generally a good idea to review your home insurance policy at least once a year, or whenever you experience a significant life change, such as a home renovation, the addition of a new roof, or the purchase of valuable new possessions.

Conclusion

Protecting your home with comprehensive insurance coverage is an essential part of responsible homeownership. By understanding the different types of coverage, evaluating your specific needs, and navigating the insurance landscape, you can ensure that your home and belongings are safeguarded against unexpected events. Remember to regularly review and update your policy to maintain the appropriate level of protection, and be prepared to navigate the claims process should the need arise. With the right home insurance in place, you can have peace of mind and focus on enjoying the comforts of your home.