Insurance Quotes: Compare Rates for the Best Coverage Today!

In the ever-evolving world of insurance, the ability to obtain accurate and reliable insurance quotes has become a crucial aspect of making informed decisions. Insurance quotes not only provide a glimpse into the financial implications of various coverage options but also empower individuals and businesses to make well-informed choices that align with their specific needs and budgets.

Understanding Insurance Quotes

Insurance quotes are personalized estimates provided by insurance providers that outline the cost of coverage for a particular individual or entity. These quotes take into account various factors, such as the type of insurance, the level of coverage, the individual’s or business’s risk profile, and geographical location, among other considerations.

Importance of Accurate Insurance Quotes

Obtaining accurate insurance quotes is essential for several reasons:

- Cost Comparison: Insurance quotes allow individuals and businesses to compare the prices of different insurance providers, enabling them to find the most cost-effective coverage.

- Coverage Optimization: Accurate quotes help ensure that the chosen insurance policy provides the necessary level of protection, without over- or under-insuring.

- Risk Management: By understanding the cost implications of different coverage options, individuals and businesses can make informed decisions to mitigate potential financial risks.

Factors Influencing Insurance Quotes

Numerous factors can impact the final insurance quote, including:

- Demographic Information: Age, gender, marital status, and occupation can all influence insurance premiums.

- Driving Record: For Auto insurance, a clean driving record with no accidents or traffic violations typically results in lower premiums.

- Claims History: Past claims made on an insurance policy can affect future premium rates.

- Coverage Limits: Higher coverage limits generally lead to higher insurance premiums.

- Deductibles: Policies with higher deductibles tend to have lower monthly premiums.

- Discounts: Insurance providers often offer discounts for various factors, such as bundling policies, maintaining a good credit score, or being a member of certain organizations.

Navigating the Insurance Marketplace

The insurance marketplace can be complex and overwhelming, with a multitude of providers and policy options available. Navigating this landscape effectively requires a strategic approach.

Researching Insurance Providers

When seeking insurance quotes, it’s crucial to research and evaluate a diverse range of insurance providers. This includes considering factors such as:

- Reputation and Financial Stability: Ensure the insurance provider is reputable and financially sound to guarantee the coverage will be honored in the event of a claim.

- Customer Satisfaction: Review customer reviews and ratings to gauge the provider’s level of service and responsiveness.

- Coverage Offerings: Assess the breadth of coverage options available to find a policy that meets your specific needs.

Utilizing Online Insurance Comparison Tools

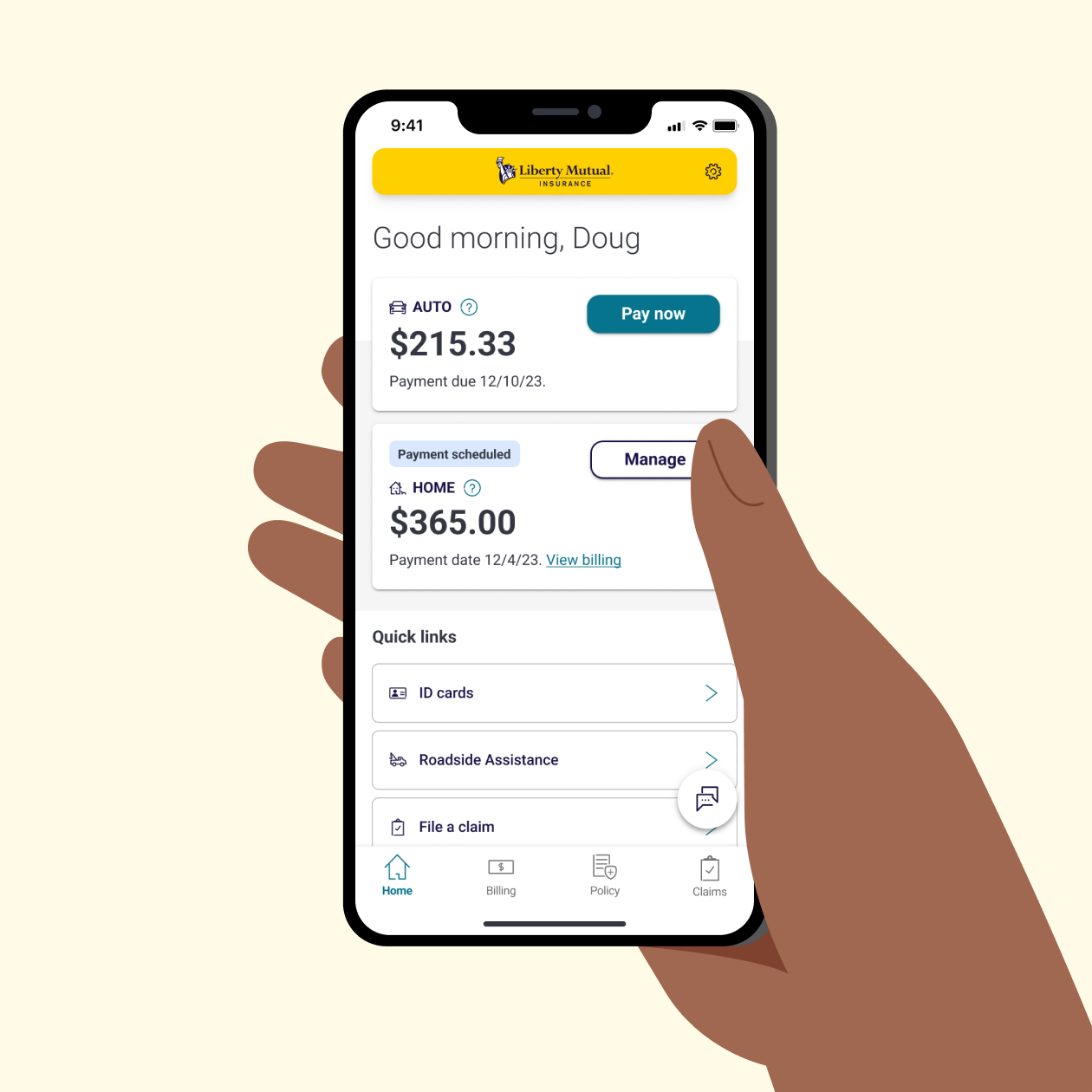

Advancements in technology have made it easier than ever to compare insurance quotes. Online comparison tools allow individuals and businesses to input their relevant information and instantly view and compare quotes from multiple providers.

- Efficiency: Online tools streamline the quote-gathering process, saving time and effort.

- Transparency: These platforms provide a clear and transparent view of the available options, enabling informed decision-making.

- Personalization: Many comparison tools offer customization features, allowing users to tailor their search criteria to their specific needs.

Seeking Professional Advice

For complex insurance needs or to navigate unique situations, seeking the guidance of a licensed insurance agent or financial advisor can be highly beneficial.

- Expertise: These professionals have in-depth knowledge of the insurance industry and can provide valuable insights and recommendations.

- Personalized Guidance: A professional can help analyze your specific circumstances and suggest the most appropriate insurance coverage.

- Advocacy: In the event of a claim, a licensed agent can act as an advocate, helping to ensure a smooth and successful resolution.

Optimizing Insurance Quotes for Specific Needs

Different individuals and businesses have unique insurance requirements, and optimizing insurance quotes to fit these needs is crucial.

Personal Insurance Quotes

When seeking personal insurance quotes, factors such as age, health status, lifestyle, and family situation play a significant role in the final cost of coverage.

- Health insurance: Obtaining accurate quotes for health insurance policies requires considering factors like pre-existing conditions, coverage levels, and deductibles.

- Life insurance: Quotes for life insurance policies depend on age, overall health, and the desired coverage amount and duration.

- Home and Auto Insurance: Quotes for these types of insurance are influenced by factors like the property’s value, location, and driving history.

Business insurance Quotes

Businesses face a diverse range of risks, and obtaining tailored insurance quotes is essential for protecting their operations and assets.

- General Liability Insurance: Quotes for this coverage are influenced by the nature of the business, its operations, and the perceived level of risk.

- Property Insurance: Quotes for property insurance depend on factors like the value of the business’s physical assets, location, and the potential for natural disasters.

- Workers’ Compensation Insurance: Quotes for this coverage are based on the business’s industry, employee count, and claims history.

Maximizing Savings on Insurance Quotes

While obtaining the necessary insurance coverage is crucial, it’s equally important to find ways to optimize costs and maximize savings on insurance quotes.

Exploring Discounts and Bundling Opportunities

Insurance providers often offer a variety of discounts to attract and retain customers. Researching and taking advantage of these discounts can lead to significant savings.

- Multi-Policy Discounts: Bundling multiple insurance policies (e.g., home and auto) with the same provider can result in substantial discounts.

- Good Driver/Homeowner Discounts: Maintaining a clean driving record or owning a home can qualify individuals for additional savings.

- Professional and Affiliation Discounts: Belonging to certain organizations or professional associations may entitle individuals to preferred rates.

Adjusting Coverage Levels and Deductibles

Carefully evaluating the coverage levels and deductibles within an insurance policy can also help optimize insurance quotes.

- Coverage Adjustments: Reducing coverage limits or opting for higher deductibles can lead to lower monthly premiums, although this may increase out-of-pocket expenses in the event of a claim.

- Deductible Adjustments: Increasing the deductible amount can significantly lower the insurance premium, but this strategy should be balanced with the individual’s or business’s financial capacity to cover potential claims.

Periodic Policy Reviews and Renegotiations

Regularly reviewing insurance policies and renegotiating quotes can help ensure that individuals and businesses are consistently getting the best possible rates.

- Life Changes: Major life events, such as marriage, retirement, or a change in employment, may warrant a review of insurance policies and quotes.

- Market Fluctuations: Periodic reviews can help identify any changes in the insurance market that may warrant a policy adjustment or a switch to a new provider.

- Renegotiation Opportunities: Engaging with insurance providers to renegotiate quotes, especially when there are no claims or changes in risk factors, can lead to additional savings.

FAQs

What information do I need to provide when requesting insurance quotes?

To obtain accurate insurance quotes, you typically need to provide personal information such as your age, gender, marital status, and occupation. For specific insurance types, additional details may be required, such as your driving record, the value of your home or vehicle, and your current coverage levels.

How can I ensure I’m comparing apples-to-apples when reviewing insurance quotes?

When comparing insurance quotes, it’s important to ensure that the coverage levels, deductibles, and policy limits are consistent across providers. Look for policies that offer the same or similar coverage options to make a fair comparison.

What factors can I control to lower my insurance premiums?

Some factors that can help lower your insurance premiums include maintaining a clean driving record, implementing security measures for your home or business, and bundling multiple policies with the same provider. Adjusting your coverage levels and deductibles can also lead to cost savings.

How often should I review and renegotiate my insurance policies?

It’s generally recommended to review your insurance policies and quotes at least once a year, or whenever there are significant changes in your life or business. This allows you to take advantage of any new discounts or market shifts that may lead to lower premiums.

What should I do if I encounter issues with my insurance provider?

If you have any concerns or disputes with your insurance provider, it’s important to communicate clearly and follow the proper channels for resolution. This may include filing a formal complaint with the provider, the state insurance department, or seeking the assistance of a licensed insurance agent or attorney.

Conclusion

Navigating the world of insurance quotes can be a complex and daunting task, but with the right approach and understanding, individuals and businesses can unlock the power of these valuable tools. By researching insurance providers, utilizing online comparison tools, and seeking professional guidance, you can make informed decisions that protect your financial well-being while maximizing cost savings. Remember, regular policy reviews and a proactive approach to managing your insurance coverage can ensure that you always have the right protection in place.